- WELLS FARGO ONLINE MOBILE BANKING LOGIN IN ACCOUNT DOWNLOAD

- WELLS FARGO ONLINE MOBILE BANKING LOGIN IN ACCOUNT FREE

The entity created by federal regulators to oversee SVB, the Deposit Insurance National Bank of Santa Clara, has quite a few things to sort out. Wells Fargo said it was working to resolve issues with its online banking services Friday after customers reported problems, including missing paychecks, on social media. does not offer deposit products and its services are not guaranteed or insured by the FDIC or any other governmental agency. Merchant Services are not deposit products. "It's really just a fear that has gripped the market, and is sort of self-perpetuating at this point," says Shaw. Merchant Services are provided by Wells Fargo Merchant Services L.L.C.

Your mobile carrier’s message and data rates may apply.

WELLS FARGO ONLINE MOBILE BANKING LOGIN IN ACCOUNT FREE

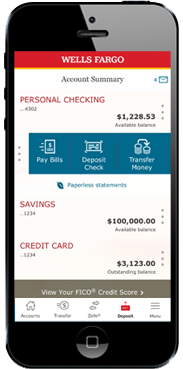

The account features: free transactions at Wells Fargo ATMs mobile access. Availability may be affected by your mobile carrier’s coverage area. You can do this from either iTunes, the Window’s Store, or the Google Play Store.

WELLS FARGO ONLINE MOBILE BANKING LOGIN IN ACCOUNT DOWNLOAD

Wells Fargo analyst Shaw also said other banks were hit by panic selling. Wells Fargo calls Everyday Checking its best checking account for managing day-to-day financial needs. Use any web browser to visit 1 Alternatively, you can download Wells Fargo’s mobile app for your phone. "We do not believe there is a liquidity crunch facing the banking industry." It is generally wise to set up a web profile for any bank via the website or in the actual. "We want to be very clear here," they wrote. A user must first sign in in order to view or manage their accounts. Yet by Friday, fears about the health of the broader banking sector had eased, even before the FDIC took over SVB.īank analysts at Morgan Stanley said in a note "the funding pressures facing" Silicon Valley Bank "are highly idiosyncratic and should not be viewed as a read-across to other regional banks." Bonds and stocks have been hammered since last year, as the Federal Reserve has raised interest rates aggressively, and SVB also noted it wanted to pare down its bond portfolio to avoid further losses.īut that announcement spooked the bank's clients, who got worried about SVB's viability, and then proceeded to withdraw even more money from the bank - a textbook definition of a bank run.Įconomy Federal Reserve Chair Jerome Powell warns inflation fight will be long and bumpy SVB said earlier this week, that in order to make good on those withdrawals, it had to sell part of its bond holdings at a steep loss of $1.8 billion. That filled the lender's coffers, and SVB had about $174 billion in deposits.īut in recent months, many of Silicon Valley Bank's clients had been withdrawing money at a time when the tech sector as a whole has been suffering. Silicon Valley's business boomed as tech companies did well during the pandemic. The bank suffered a run on deposits that led to its collapse. People walk through the parking lot at the Silicon Valley Bank headquarters in Santa Clara, Calif., on March 10, 2023.

0 kommentar(er)

0 kommentar(er)